New report slams Branstad tax plan

Corporate property tax cuts could lead to budget cuts, job losses, and greater income inequality, new report states

Closing corporate tax loopholes and making the richest 1% of Iowans pay their fair share of taxes is key to economic growth and prosperity that puts the 99% of everyday people first

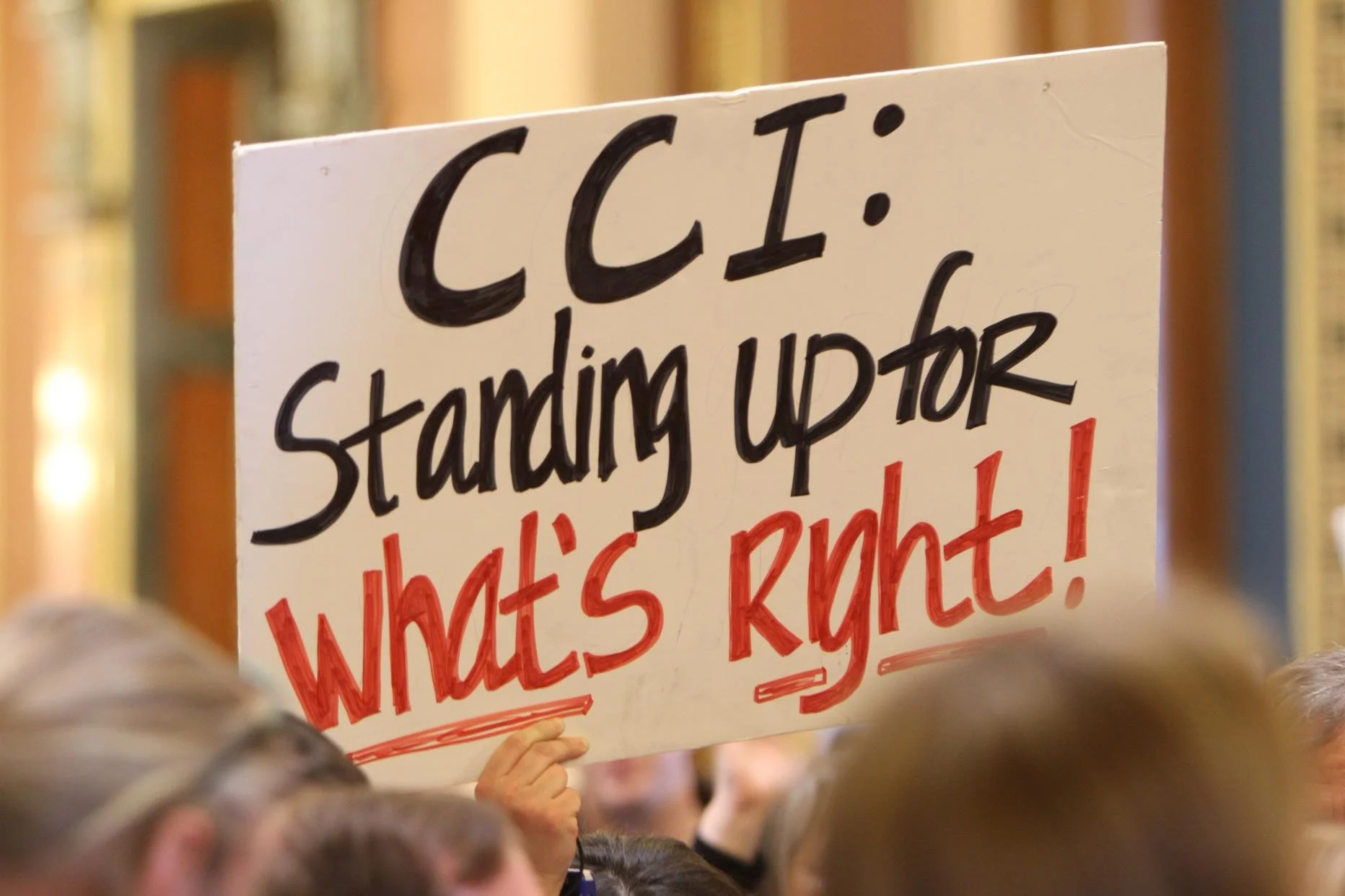

Closing corporate tax loopholes on out of state corporations doing business in Iowa and making the richest 1 percent of Iowans pay their fair share in taxes could offset revenue lost from a deal to cut corporate property taxes and actually strengthen vital public services, according to a new report titled “The Cost of Cuts in Iowa: Budget cuts hurt families, communities, and the economy” by Iowa Citizens for Community Improvement Action Fund (CCI Action) and the Alliance for a Just Society.“UNI is slashing more than a quarter of its academic programs, 37 workforce development offices have closed, the DNR doesn't have the factory farm field staff to enforce clean water laws anymore, and Branstad’s proposal to cut corporate property taxes threatens local governments’ ability to deliver what little critical public services we have left,” said Kenn Bowen, a retired communications worker and Vietnam veteran from Winterset.“We cannot afford more tax and spending cuts and still maintain the quality of life that is necessary for economic growth and development. Enough is enough. The money to rebuild our state is out there and it’s time for big corporations and the richest 1% of Iowans to start paying their fair share.”

According to the report:

- 580 jobs are lost with every 1% in spending cuts.

- Iowa lawmakers have cut spending by 15% since 2009 and 27% since 2001.

- Iowa’s richest 1% only pays 6% of their income in state and local taxes.

- Iowa’s poorest families pay 11% of their income in state and local taxes.

“The cost of Governor Branstad’s radical property tax cut proposal is enormous, as it would result in cuts to police and fire security, libraries, road maintenance, and safety inspections,” the report reads.“Meanwhile, Iowa’s tax system lets the state’s wealthiest residents off the hook for contributing to a prosperous economy from which all can benefit. By choosing the path of divestment over equitably raising revenue, state lawmakers are compounding economic inequality.”Making the 1% pay their fair share and closing corporate tax loopholes on out of state corporations doing business in Iowa – otherwise known as combined corporate reporting – would add more than $100 million annually to state coffers and the new revenue could be used to fully fund public schools, environmental protections, workforce development, wage theft enforcement, and other vital services. Combined corporate reporting would also make Iowa-based businesses more competitive, fueling local economic growth. Please "Like" or "Tweet" below to share this report with your networks: