The good and the bad: legislation we're tracking

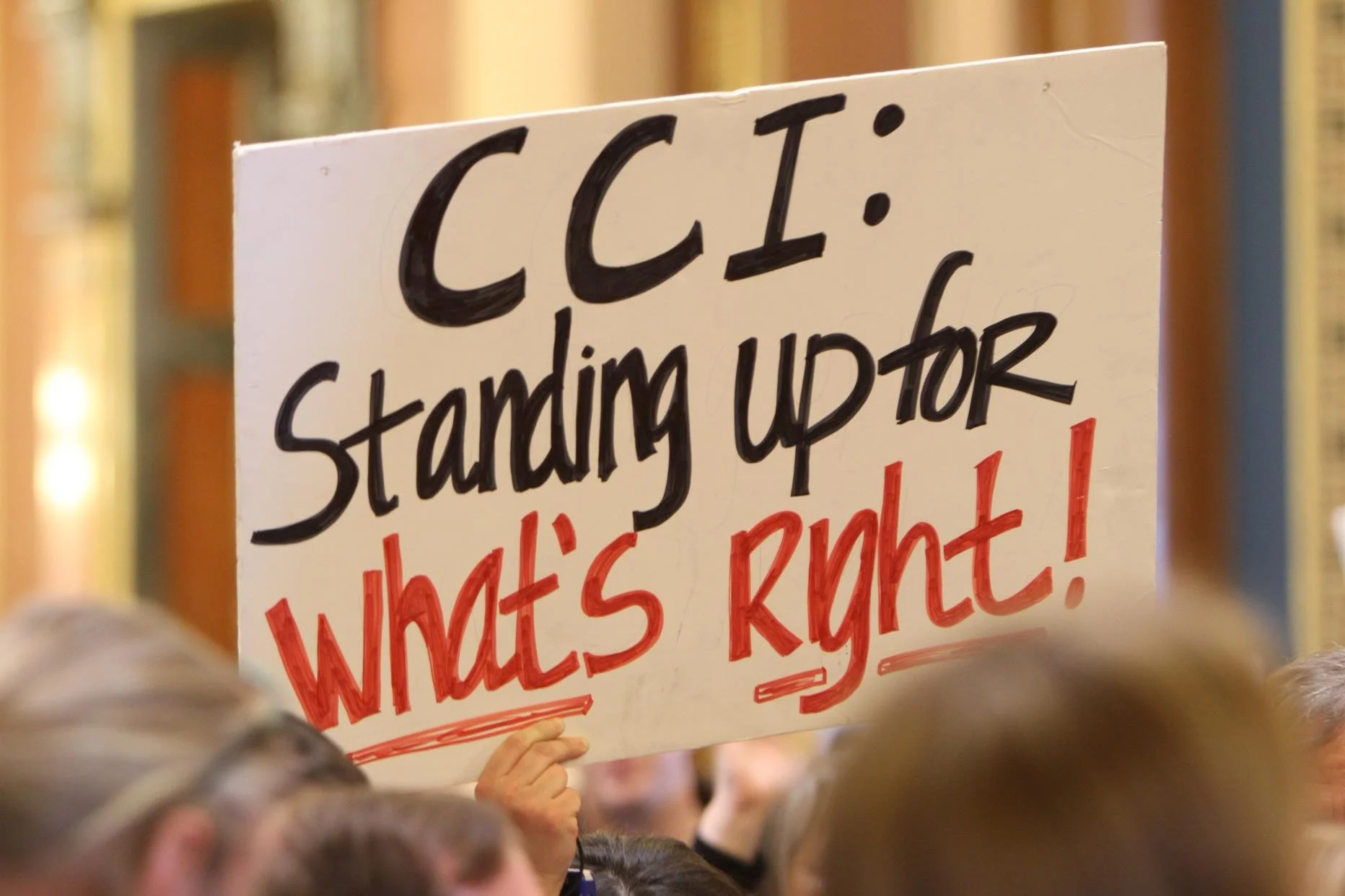

We want legislators to pass bills that put people first before polluters, politics and profits.That's why our staff and supporters monitor bills at the Iowa Statehouse – both good and bad – to let you know when your call or email can have the biggest impact possible.Below is a list of good and bad bills we have our eye on this session. Please keep in mind that bill numbers can and do change often. If you have any questions about a bill below, give us a call at 515-282-0484.

Good Bills that Put People First!

SF 388 - Payday Loan Interest Rate Caps: Limits the interest rates on payday loans to 36%. This is down from an average of 400% and will help break the cycle of debt caused by predatory payday loans. It passed the Senate Human Resources Committee and was referred to the Senate Commerce Committee, where it sits now. Two other payday loan bills were introduced in the House which we are monitoring.SF 116 / HF 2060 - Wage Theft: Penalizes employers who engage in wage theft and provides for repayment of wages with interest to victims of wage theft. This bill passed the Senate last year and Rep. Bruce Hunter has introduced companion bill HF 2060 in the House this year.HF 2192 - IOWA Act: Allows undocumented immigrant students who have lived in Iowa at least five years to qualify for in-state tuition at Iowa’s public universities. It would encourage immigrant students to stay in school, find a pathway to citizenship, and find higher-paying jobs that add to Iowa’s tax base. Introduced by Rep. Ako Abdul Samad again this year to the House Education Committee.SF 2161 - Earned Income Tax Credit: This is a tax credit for people who work and have relatively low wages. Currently the credit maxes out at $379 a year for a married couple with three children making about $43,000 a year, or $32 for a single adult making up to $13,450. An increase would provide millions of dollars in tax relief to working families with incomes less than $45,000 a year. Supporters estimate this would help more than 500,000 people in Iowa. Senator Joe Bolkcom has told Gov. Branstad that his Senate Ways & Means committee will not even look at Corporate Property Tax Cuts until this bill is signed.HF 2271 – Banning Corporate Contributions: Bans banks, credit unions, S & Ls, insurance companies and corporations from making contributions to a political committee or expressly advocating for the election or defeat of a candidate. This would help reduce the impact of Citizen’s United and reduce the flow of corporate cash into Iowa’s elections. This bill was introduced to the house State Government committee.HF 28 – Local Control: Allows counties to pass siting ordinances that determine where and when a factory farm can be built. This gives counties and local people – who know their area best – the final say in whether a factory farm can be constructed. This bill has been introduced to the House Ag Committee.Combined Corporate Reporting: Requires out-of-state corporations to combine their reporting of profits and pay their fair share of taxes to the state of Iowa on those profits rather than funneling them out of state. This would keep at least $100 million per year in revenues in the state and ensure Iowa-based businesses have a fair and level playing field with huge out-of-state corporations. This bill would go before the Ways & Means Committees, and could be added into Tax Reform that is already being planned to offset the costs of cutting corporate property taxes.HF 129 - Voter-Owned Iowa Clean Elections (VOICE): Establishes a voluntary system for state elections where candidates can use public financing instead of constantly raising funds from special interest groups who try to buy candidates. This would allow candidates to focus on the issues and their constituents rather than constantly catering to their big money supporters. VOICE revenues could come from a 5% charge on political donations over $250 in HF 140. VOICE feasibility study would be conducted under HF 204. HF 359 is a variation of VOICE which would provide matching publicly financed grants of small in district contributions to participating candidates. All were introduced to the House State Government Committee last year.SF 20 – Insurance Rate Increase Disclosure: Requires insurance companies to disclose why they are hiking insurance premiums in plain and easy to understand language. This bill was introduced to the Senate Commerce Committee last year.

Bills that DON'T Put People First!

Gutting Factory Farm Enforcement: Many of these bills take authority for rulemaking out of the hands of the Environmental Protection Commission (the citizen oversight board for the Department of Natural Resources) in various ways and prevent new environmental regulations to be placed on the factory farm industry. CCI will oppose any attempts to gut the EPC & DNR of its factory farm oversight. In addition, other bills seek to deregulate the factory farm industry in one way or another, carving out loopholes that no other industry in Iowa has.

• HF 589- AG Gag: This bill which was stalled last year, returned quickly this year. After CCI members spoke out, the bill, which would have criminalized folks who try and hold factory farms accountable by taking pictures or video, was gutted by Amendment S-5004. Our point now is simply that this bill as amended is a waste of time and is bad policy, re-stating that trespassing and misrepresenting yourself is a crime.

• SF 2172- Kibbie’s Factory Farm Loophole Bill: This bill would allow factory farms to raise Gilts on site for breeding purposes without counting them towards the total number of animal units. This is a giant loophole for the corporate factory farm industry that Senator Kibbie is pushing through the Senate under the guise of “bio-security.”

Several bills are being proposed that will slow down the agency rulemaking process and make it more burdensome to pass rules:

• HF 2199/SF 2116 – Rulemaking Rolling Review: Rep. Dawn Pettengill & Senator Merlin Bartz, who chaired last year’s “red tape hearings”, are pushing this bill to gut rulemaking authority. It requires the creation of a citizen advisory committee for Administrative Rules Review Committee (ARRC), that a list of principal reasons for and against a rule and job impact statements be done for every rule, the creation of ad hoc negotiated rulemaking groups, and that reviews of every rule on a five-year cycle be done. This would cause the rulemaking process to be unduly influenced by corporate interests, and also have every rule thrown out after 5 years, causing a loss in public oversight.

• HF 2200 - Legislative Rule Approval: This bill would require that any new rule or action on a rule be approved by legislators in a joint resolution and signed by the Governor within one year of the effective date of the rule or action. This would slow the impact of rules from taking effect, and make it virtually impossible to pass good public oversight rules.

• HF 2213 - Rules Suspensions: This bill allows the ARRC to suspend the applicability of a rule on a 2/3 vote after delay or session delay or objecting to a rule. This would slow important regulations from taking effect, and allow a few legislators to dead-end good administrative rules.

• HF 2030 – Legislative Rule Approval (pt. 2): This bill would give final authority on any rulemaking with a fiscal impact to the Legislature and Governor, again delaying and politicizing the rulemaking process.

HF 629/HF 2156 - Arizona/Alabama Style Immigration Bills: This legislation would endanger public safety, lead to racial profiling, and make it harder for many state and local officials to do their job. It would force local law enforcement to enforce federal immigration law. State agencies (like Iowa Workforce Development) and officials could share information with Immigrations and Customs Enforcement (ICE). These bills will work through the House & Senate Judiciary Committees.HF 2041- Construction Contractor Registration: This bill would end requirements for contractors to register, making it even harder for Iowa Workforce Development to punish bad actors. Taking away a contractor license is not something that IWD does right now, but it could be a good punishment for contractors who don’t pay their wages. If they don’t even need to register, then that threat is not there.HSB 582/ SSB3086 - Voter ID: The Secretary of the State, Matt Schultz, has already started pushing this bill. This bill would require all voters to show a picture ID. Voter ID disenfranchises low-income people, minorities, and senior voters (at least 11% of whom have no picture ID). This bad bill will be an added cost to state and local governments, and is a “solution in search of a problem.” You are more likely to be struck by lightning than to have your vote canceled out through voter fraud. This bill passed the House last year, stalled in the Senate, but has been re-introduced in both chambers.HF 2274/ Corporate Property Tax Reform: This bad bill proposed by the Governor would cut corporate property taxes, and force local governments to cut local budgets as well. A House Republican version is slightly different. Senate Democrats have offered a version that focuses on small business owners. Our message is that corporate property taxes should not be cut. Period. If it is “inevitable”, all revenue losses should be offset by closing corporate tax loopholes with combined corporate reporting.SF 2144 - No Dues from Undocumented: This bill would prohibit labor unions and other organizations from knowingly accepting membership dues from undocumented Iowans. It would lead to folks who work hard and want to better their community, and organizations that help them do that, being criminalized.Privatizing Economic Development: This bill passed last year to form a “non-profit organization” allowed to accept tax-deductible contributions hidden from public oversight, then dole out this money alongside public funds with no public oversight. This is a back door tax break allowing big corporations and special interests to pick economic winners and losers. We will monitor Senate & House Economic Growth Committees for an expansion of this bad legislation. A number of bills are coming out this year creating new development funds, or asking for special exemptions. We will continue to monitor bills associated with Branstad’s Public Private Partnership.

• HF 2029 – Employer Advocacy Council: This bill would create a new commission within the Iowa Partnership for Economic Progress to seek out “burdensome & job killing regulations” from businesses and corporations around the state, then make recommendations to the legislature every year. Our question is – “where are the commissions that are pushing for stronger regulations?”

HSB 517/SSB 3009 - Privatizing Public Education: One of Governor Branstad’s announced priorities is Education Reform. While we are still digging in on the details, much of what he has been proposing includes privatizing our public education, “teaching to the test,” and creating an unfair tiered pay scale for teachers. Want to get up-to-date reports from the Statehouse and be informed when your call or email can have the biggest impact? Join our email list today!Support our legislative work to put our communities before corporations by donating today.Also, follow our Twitter account for live updates from the statehouse: www.twitter.com/IowaCCIAction